Passive income crypto isn’t just a dream. Even for a complete beginner without a lot of money, it’s an easily attainable goal.

NOTE: This is not financial advice. Please consult a qualified financial or investment advisor if you are seeking that kind of advice. Neither financial nor investment advice will be found here or in the other content that I share.

In this post about passive income crypto, I’ll show you how I chose a token to invest in, how to get a Coinbase account, how to set up repeat investments on auto-pilot, and how to stake your tokens so that you earn a return regardless of market fluctuations.

Step 1 – Choose A Token To Invest In

Bitcoin and Ethereum aren’t the only candidates by a long shot, but they lead the entire pack in market capitalization (or market cap). Which means that they are well established and highly unlikely to vanish or fail.

Coinmarketcap.com is a great resource for understanding who the dominant players are at a glance by market capitalization. Looking at lifetime charts (click “All” on the period selector – top right) reveals the cyclical nature and general upward trend of the crypto markets.

Step 2 – Get A Coinbase Account

Coinbase makes it easy for beginners to get started on a secure and reputable exchange.

To help you get started on your crypto journey, they’re currently giving $5 BTC for signing up. They give $10 BTC more once you’ve bought or sold your first $100.

They go much further than helping you learn about various cryptocurrencies. They incentivize it with their Learn and Earn program where you watch short videos about cryptocurrency and get some of the subject tokens free after a short (usually 3 question) quiz.

Click here to start your Coinbase account with $5 free BTC

Step 3 – Set Up An Affordable Recurring Investment

This part is a super-simple step on your passive income crypto journey.

Make a recurring investment regardless of market fluctuations. This is called Dollar Cost Averaging or Averaging In.

The general upward trend over time makes the downward (or “bearish”) cycles a great friend to recurring investors.

When the price goes down, your regular investment will buy more of your chosen token without you making a change.

When the price rises, the overall value of your holdings rises as well.

Here’s how to set up your recurring investment on Coinbase:

- Click on Trade

- Change the Investment Type from “One Time Purchase” to “Recurring Buy“

- Choose “Daily”, “Weekly”, “1st and 15th of the month”, or “Monthly”

- Input your Recurring Buy amount. Make sure it’s an amount you can comfortably keep going. Even $10 a week adds up over time

- Choose a Token

- Click on Preview Buy

- Click on Buy Now

Step 4 – Stake Your Proof of Stake (PoS) Tokens – Passive Income Crypto On Blast

This step may even be simpler than the last!

Here’s how to stake your tokens on Coinbase (using ETH for this example):

- On the Assets page, select the token you want to stake

- Click on “Stake Now”

- Click “I Understand” once you’ve read the important info

- Choose your amount

- Click “Stake Now”

Here’s how to stake your other Proof of Stake tokens on Coinbase

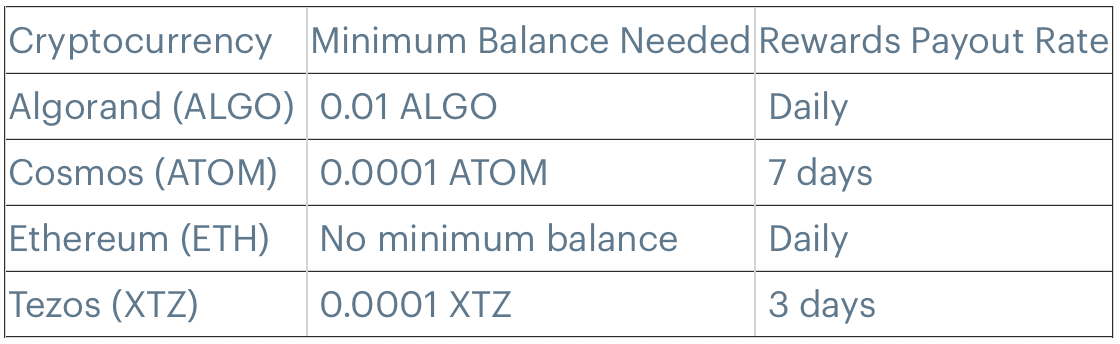

In case you were wondering, other Proof of Stake tokens can also be staked on Coinbase. A complete list is below.

To begin seeing returns on any of the crypto tokens above, make sure you have some of these Proof of Stake tokens in your account.

Once you meet the identity verification and minimum balance requirements, you can expect payouts as above and as noted here: Staking and inflation on Coinbase.