Disclaimer: I’m not a financial professional. This is neither investment advice nor stock-picking advice. You will need to consult with a professional for that. I can only share what tools I like, and what I do for myself. That said, I’m going to tell you how to get FREE stocks on Robinhood and Webull.

Passive Income In Two Flavors

You’ve probably noticed that any money you may have sitting in a savings account isn’t working very hard for you. These days, you’re lucky if you find a 1% interest rate. Not what I’d call a good source of passive income.

Enter the stock market. No. Literally. Enter the stock market! Take the time (no time at all really) to download a free stocks app that offers a FREE stock as an incentive, then invest in dividend-paying stocks.

There are several companies that will give you a FREE stock share as an enticement, but two stand out for beginners because they eliminate almost all the usual barriers to entry, but give you access to some pretty useful features. Robinhood and Webull both allow anyone to quickly get started trading stocks, ETFs, options (options are NOT recommended for beginners), and even cryptocurrency.

Net Gain (What Your Share Is Worth)

Any return on your newly acquired FREE share of stock can be considered passive income by virtue of your having made a single up-front investment at $0. A FREE stock valued at $5, represents a net gain of $5 since you paid $0 for it. If the value increases, then that’s more income. If the value decreases, then you still realize a net gain because you paid $0 on the front end.

Between the two brokerages, Robinhood is my favorite because you can trade fractional shares. This means that you can invest in the “big boy” companies that perform well and pay dividends but are usually priced out of reach for people without high incomes or substantial savings.

Dividend Income

Generally speaking, when publicly traded companies do well they either re-invest the profits or payout dividends to their shareholders.

Dividends are what we’re interested in. This way, we can take advantage of the average 10%-or-so long-term stock market return, then reinvest any dividends that we’re paid (usually quarterly), get the return on that, and let it snowball. Not a bad deal for something we got for free.

That dividend and its reinvestment is by definition passive income. You do the work once and get paid multiple times from that one investment.

Why I Like Robinhood (But Webull FREE Stock Is Just As FREE)

Pros And Cons

Let’s do a little comparison here. Robinhood and Webull have very similar features that benefit beginners:

- $0 commission fees on for stock, ETF, and cryptocurrency trades

- $0 fees on options trading (again – this is not for beginners)

- No account balance minimums

Where they differ:

- Robinhood only offers taxable accounts. Webull offers taxable, plus IRAs.

- Robinhood offers dividend re-investment and fractional shares. Webull does not.

- Webull has better charting and more robust customer service.

In either case, just for downloading their app, opening and funding an account, you get a FREE stock.

With Robinhood, you don’t even have to make a deposit, just link your bank account and get a share of stock valued between $2.5 and $225. Chances are that most will be $10 or less, but it’s FREE. If you later refer a friend, they again give you a FREE stock. From time to time, they’ll double – even triple – that offer for a limited time.

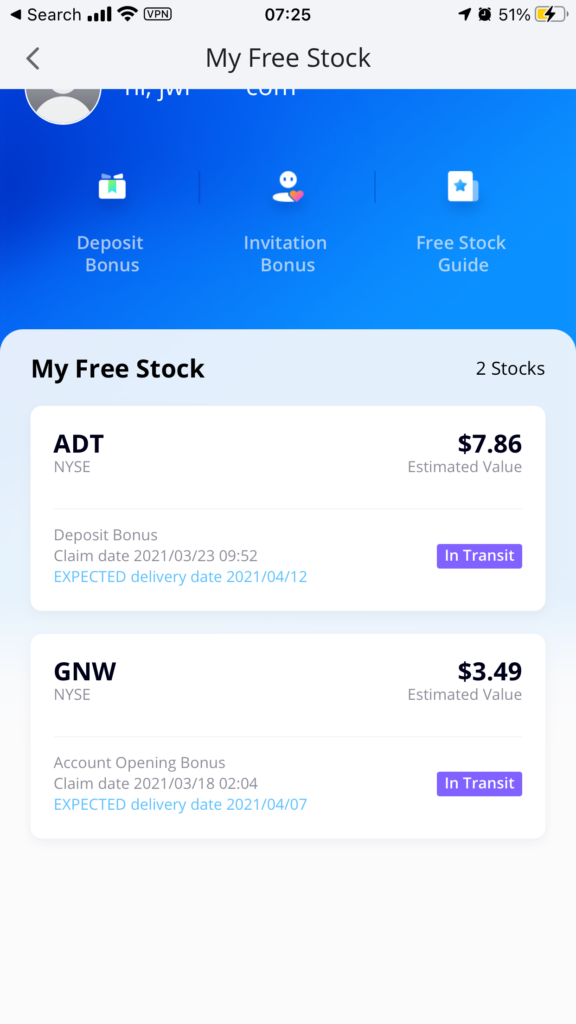

Webull’s current offer is that if you open an account between 02/02/2021 – 03/31/2021, you get a FREE stock valued between $2.5 – $250. Then, if you make an initial deposit of $100 or more, you get a FREE stock valued between $8-$1600!

What Have I Done?

Which did I pick? I’ve picked both apps. My first free stock was from Robinhood back in February 2020. It was valued at $4.76, now down to $2.03. I just got 2 from Webull currently estimated at $7.86 and $3.49. Only 1 of the 3 pays dividends, but again, they were FREE.

Making Your Own Luck (Risk And Potential)

Now that you know how to get FREE stocks on Robinhood and Webull, let’s think about what to do with it. Anyone could easily look at these FREE yet small gift stocks and dismiss them as inconsequential. Doing so, in my opinion, is a HUGE mistake. Too much upside (potential for gain) with little to no risk on the FREE investment.

The Power of Potential

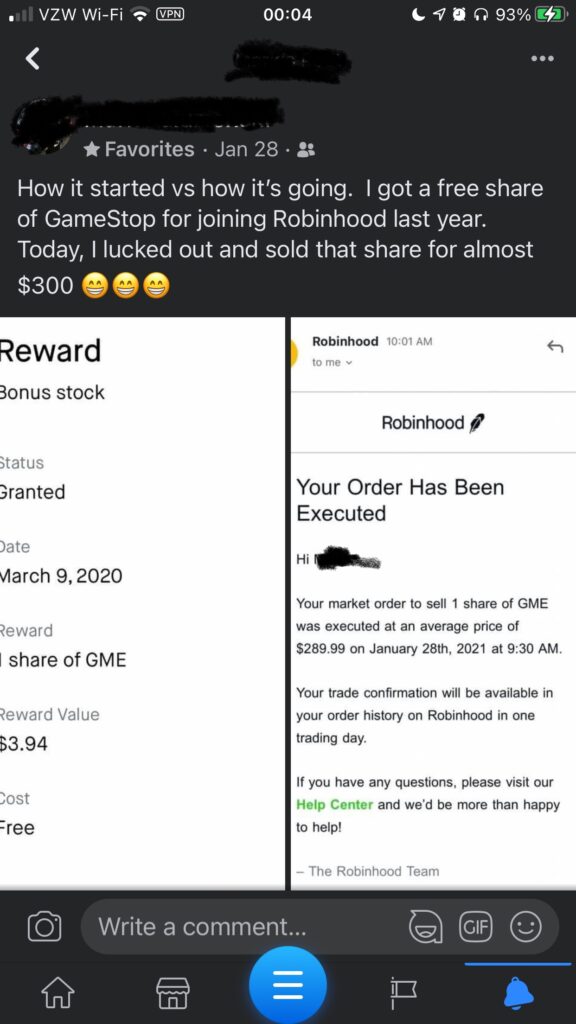

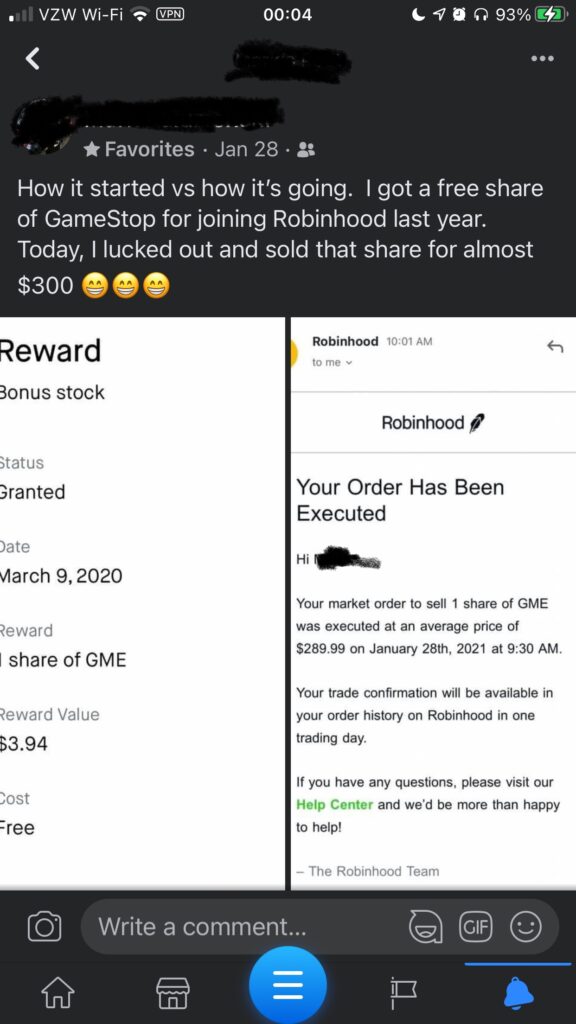

Last year a friend opened an account and got a free share of Gamestop. When the whole “short squeeze” situation happened a few months ago, he sold his $3.94 gift stock for $290 – wa-a-ay more than the $0 he paid for it. This is not typical, but it doesn’t have to be. That’s a 7,242 percent profit – ON THE GIFT AMOUNT of $3.94!

In no way is that last example typical, but it’s possible. More likely is that you luck out and get a dividend-paying stock or make your own luck by employing “dollar-cost-averaging” or some other strategy

No guarantees of getting rich here or even of getting a winning stock that rises in value. But what you will get is something that’s worth more than you paid for it. That’s a case of potential outweighing the risk.

Harnessing Potential And Spreading Risk

Another reason I tend to favor Robinhood is the ability to buy fractional shares. I schedule regular daily investments of the same small amount ($5) into 2 dividend-paying index funds and reinvest the dividends when they’re paid out.

One fund tracks an index of the 80 highest yielding stocks on the S&P 500. The other tracks an index of global companies that operate, manage or produce natural resources in energy, agriculture, metals, timber, or water.

Here, the potential lies in both the recurring dividend payout and the tendency for stock markets to rise. The better the companies do in each of these funds, the higher the dividend paid out. After 6 months or so, I’ll continue investing in the higher-paying dividend fund and seek out a better investment to replace the lower-performing one for future investments.

I am not a financial professional. This is not advice.

I am an affiliate marketer. I’m not even sure if that applies here because neither company pays me. But if you click the links above and accept their offers, you and I both get FREE stock. Not much at all in this world is free. I’ll take it. Why not you?